C-PACE programs encourage and incentivize the integration of energy-saving and renewable infrastructure in the built environment through long-term low-cost financing. Traditionally PACE financing is accessed for retrofits and new construction, but the development stage of a project isn't limited to future work. PACE financing can be applied to completed and mid-construction projects, which makes it an extremely useful tool for projects that are experiencing cost overruns such as those experiencing delays and increased costs due to the COVID-19 public health crisis.

C-PACE programs encourage and incentivize the integration of energy-saving and renewable infrastructure in the built environment through long-term low-cost financing. Traditionally PACE financing is accessed for retrofits and new construction, but the development stage of a project isn't limited to future work. PACE financing can be applied to completed and mid-construction projects, which makes it an extremely useful tool for projects that are experiencing cost overruns such as those experiencing delays and increased costs due to the COVID-19 public health crisis.

|

The Poway Outpost, a 53-unit Class AAA luxury multifamily and retail project under development in Poway, California, a San Diego suburb, recently secured $13.7 million in mid-construction C-PACE financing from CounterpointeSRE. The project experienced cost overruns from unexpected groundwater issues and increased expenses attributed to the COVID-19 crises. With project specifications that included significant seismic resiliency work (a measured covered in California) and traditional PACE-qualifying elements of HVAC, LED lighting, water conservation, and building envelope measures, the developer was well positioned to recapitalize a portion of the project with C-PACE. Read more by clicking the case study image at right. |

|

ADVANTAGES TO USING PACE FOR RECENTLY COMPLETED OR MID-CONSTRUCTION PROJECTS

|

"For mid-construction projects we're able to help developers recapitalize, recover and keep moving towards a successful finish line." |

FINANCE TERMS

- fixed-rate, non-recourse & prepayable with rates typically under 6%

- ability to capitalize interest during entire bridge period

- fully funded at closing

- flexible prepayment terms available

AVAILABILITY OF 'LOOK BACK' OR 'RETROACTIVE' PACE FINANCING

- typically 1-3 years since completion

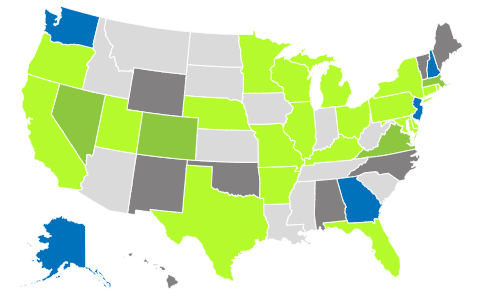

- available in the following states AR, CA, CT, CO, DC, DE, FL, IL, KY, MD, MI, MO, MN, NE, NY, OH, OR, PA, RI, TX, UT, and WI

Note 1: Bright/light green denotes PACE-enabled with look-back, darker green is PACE enabled without look-back, blue represents an enabled / non-active PACE state.

Note 2: Some PACE policies only allow for in-flight projects, or require an energy evaluation to have been performed before evaluation.